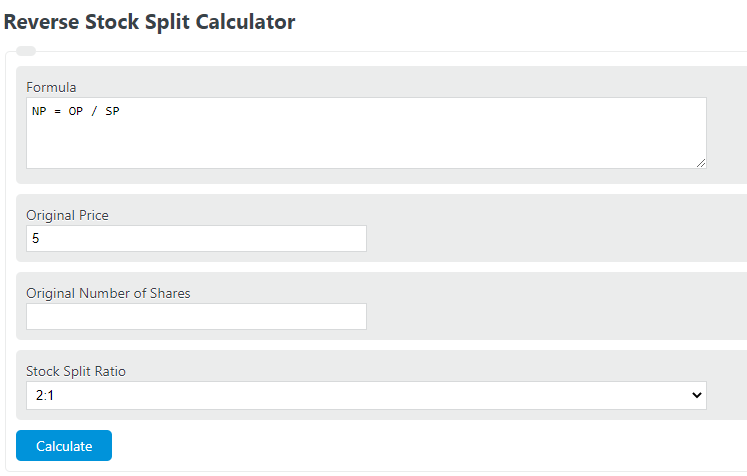

2 For 5 Reverse Stock Split Calculator

Total cost basis of stock including commissions fees total not per share adjusted for previous spinoffs or other corporate actions. The formula to calculate the new price per share is current stock price divided by the split ratio.

Reverse Stock Split What It Is What You Should Know Stockstotrade

In the example after the stock split your call options will have a strike price of 25 and the stock itself will go to 26 per share.

2 for 5 reverse stock split calculator. Another question here is why a 15 reverse split only increased the price to 40. You calculate the number of new shares that you have after the split by multiplying the ratio of the stock split. Lets say for instance a company were to execute a 1 to 5 reverse stock split.

Reverse Stock Split. Click the refresh button to clear the calculator before each use. On 522001 XYZ declared a reverse one for ten stock split.

Divide the strike price of your call options by the stock split ratio. Shares after the splitshares AB. Continuing the example if the company performed a 1-for-5 reverse stock split divide the original 100 shares by 5.

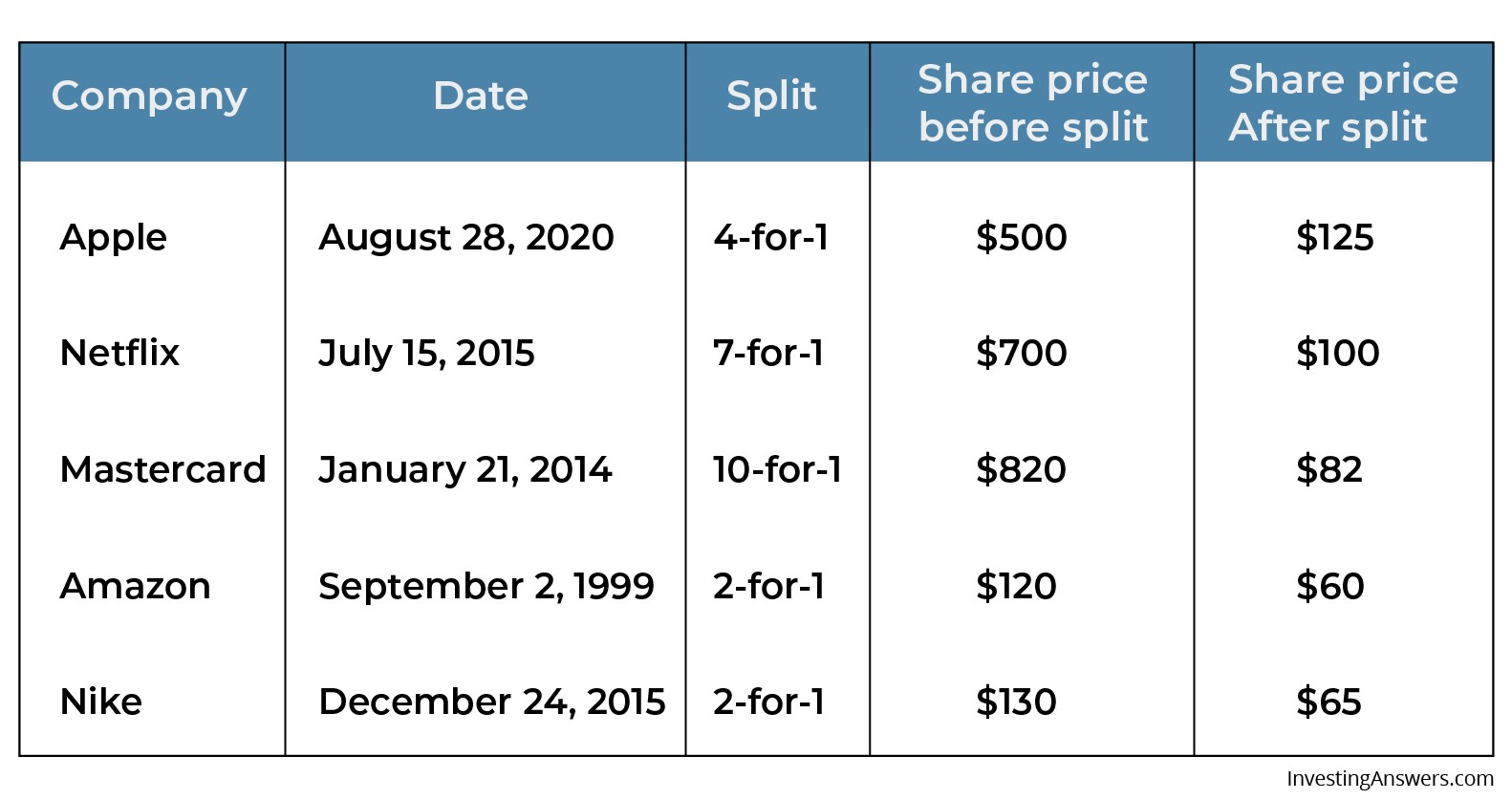

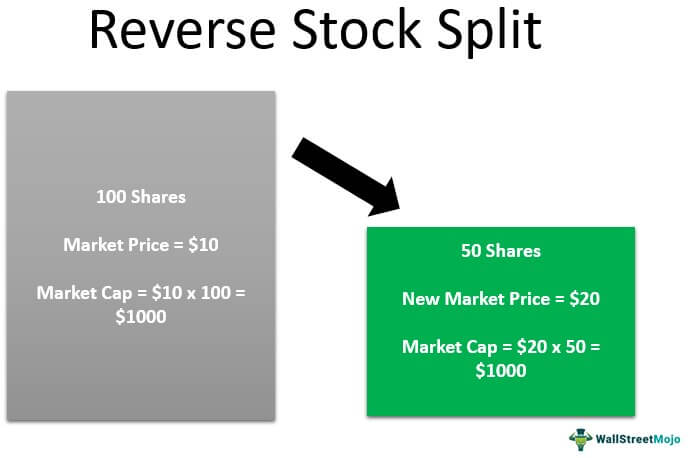

Then the shareholders would receive 1 share for every 5 previously held shares they had prior to the split. A reverse stock split is a situation where a corporations board of directors decides to reduce the outstanding share count by replacing a certain number of outstanding shares with a. For example in a 1-for-3 reverse stock split you would end up with only one new share for every three shares you previously owned.

For example a stock currently trading at 75 per share splits 32. 75 32 50. You now have 100 shares so your price per share is 600 ie 5 times the price you paid.

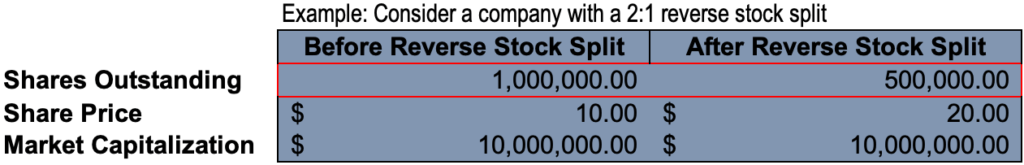

Common share swap ratios used in a reverse stock split are 12 1-for-2 110 150 and even 1100. If you owned two shares before the split the value of the shares is 75 x 2. In effect you start out with 10 shares of stock worth 200 per share and assuming there is a one-for-two reverse split you will wind up with 5 shares worth 400 per share.

5 times the 15 pre-split value is 75. Its when a company reduces the number of its existing shares by a multiple. Step 3 Repeat Step 2 for each stock split to calculate your new stock basis.

Making sense of a strange split ratio. With a 3-for-2 split multiply your old share total by 32 or 15. By 522001 the market price for the stock had fallen to 200 per share a market loss of 90.

STOCK SPLIT CALCULATOR FOR CASH IN LIEU OF FRACTIONAL SHARES. Your brokerage firm delivered off 1000 shares of the old XYZ shares and received 100 shares of the new XYZ Corp stock in exchange. Your brokerage firm delivered off 1000 shares of the old XYZ shares and received 100 shares of the new XYZ Corp stock in exchange.

To make this easier to understand lets assume for a moment you have two 50 bills. There is no set standard or formula for determining a reverse stock split ratio. When a stock that you own does a 3-for-2 split the company issues three new shares for every two old shares you had at the time of the split.

Stock price after the splitstock price BA. Like a regular stock split the number of outstanding shares changes. To calculate a reverse stock split divide the current number of shares you own in the company by the number of shares that are being converted into each new share.

You paid 60000 for your shares. For example in March 2015 pest-termite-and-rodent-killer Rollins made a 3-for-2 stock splitIts common stock. So if you owned 300 shares of the company.

How to Calculate the Basis for Multiple Stock Splits 2. Number of shares of stock before this split. For example if your stock split five new shares for every old share divide 25 by 5 to get a new basis of 5 per share.

Concurrently the pricevalue o shares will increase by the same ratio. On 522001 XYZ declared a reverse one for ten stock split. A reverse stock split is the opposite of a stock split.

That could be 10 or 20. To calculate the new price per share. The strike price of a call is the value at which an option can be exercised to buy the shares.

By 522001 the market price for the stock had fallen to 200 per share a market loss of 90.

Reverse Stock Split What It Is What You Should Know Stockstotrade

Stock Splits Explained Youtube

Stock Split Benefits Investinganswers

Stock Splits Explained Youtube

Reverse Stock Split Definition Examples And Reasons

Apple Stock Split History Everything You Need To Know Ig En

Centimeters To Inches Conversion Cm To Inches Conversion Knitting Charts Metric Conversion Chart

/ScreenShot2020-05-14at11.00.41AM-db13978279d7495f83f3d6b6a5075e0c.png)

If You Had Invested After Amazon S Ipo In 1997

Reverse Stock Splits Good Or Bad For Shareholders Youtube

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

Reverse Stock Split Meaning Example How It Works

Heart Rate Calories Burned Calculator Zones In 2021 Calories Burned Calculator Burn Calories Heart Rate Training

Reverse Stock Split Meaning Example How It Works

/GettyImages-1051266664-b8064d1c16f74ff9b139fe2ee7affa18.jpg)

Post a Comment for "2 For 5 Reverse Stock Split Calculator"